how to check income tax refund status online malaysia

How many days Income TaxITR refund amount is credited to my bank account. Income tax refund status can be checked online via income tax departments e-filing website or the TIN NSDL website.

Tax Refund Chart Can Help You Guess When You Ll Receive Your Money In 2021

4 weeks after you mailed your return.

. Your filed ITR is accepted and neither demand nor refund is due or. Yes Section 244A of the Income Tax Act provides the provisions for interest on income tax refund. No demand no refund.

Check For The Latest Updates And Resources Throughout The Tax Season. MyTax - Gerbang Informasi Percukaian. Refund processing by tax department only after e-verify of return.

Check My Refund Status. Within 90 working days after manual submission. Online Account allows you to securely access more information about your individual account.

3 min read. By visiting the E-Filing website. On the page that opens.

Sign in to My Account Register. Check My Refund Status. How do I Check my tax refund status.

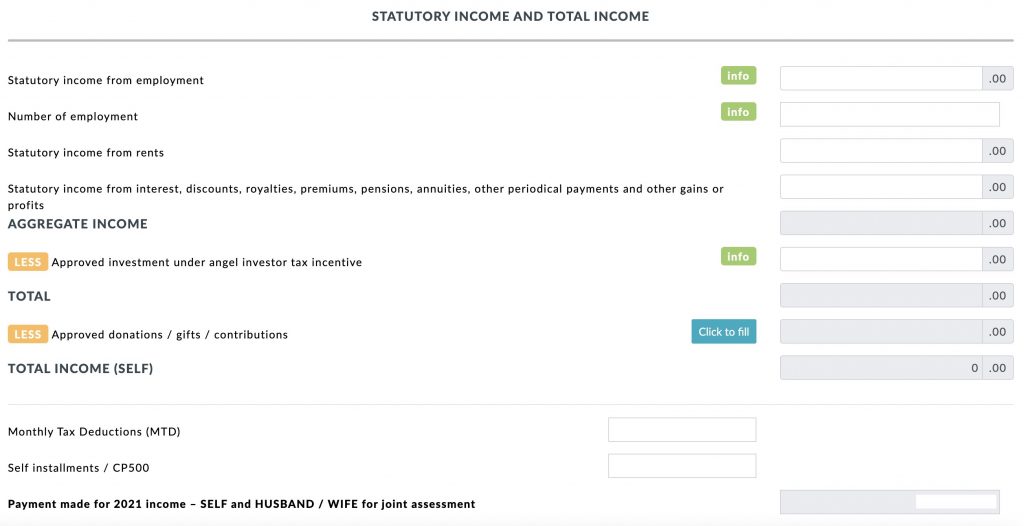

The IRBM Clients Charter sets that tax refund will be processed within 30 working days after e-Filing submission. Visit the e-filing portal. To check the status of your 2021 income tax refund using the IRS tracker tools youll need to provide some personal information.

Sign in to My Account to check the status of your tax refund. Starting from Year of Assessment 2013 any taxpayers who do not receive their refund from LHDN within the 30 days will. Hak Cipta Terpelihara 2022 Lembaga Hasil Dalam Negeri Malaysia.

Income Tax assesses can check the status of their refund online. There are two ways to check the refund status through the Income Tax E-filing Portal and another way through the TIN NSDL Portal. Section 244A prescribes interest at the rate of 05 per month or part of the month on the refund.

Bank Account No and correct address is mandatory. After the Income Tax Department sends the refund to your bank the tax refund datestatus would be updated after 10 days. Calling the IRS at 1-800-829-1040 Wait times to speak to a representative may be long Looking for emails or status updates from your e-filing website or software.

To enable credit of refund directly to the bank account Taxpayers Bank Ac MICR codeIFSC code of bank branch and correct communication address is mandatory. Enter your user ID. How to claim an income tax refund.

Starting from Year of Assessment 2013 any taxpayers who do not receive their refund from LHDN within the 30 days will. According to the IRS you can see the status of your refund 24 hours after e-filing or 4 weeks after mailing your return. Using the IRS Wheres My Refund tool.

For claiming income tax returns you have to file an online income tax return. Click on the Acknowledgement Number corresponding to the tax filing in which you have claimed a refund. How to check your Income Tax refund status online.

24 hours after e-filing. Click on the Login button in the top right corner of the website. Have not received your Tax Refund.

Checking the income tax. Check Online ITR Refund Status Via E-Filing Portal. Ad Learn About The Common Reasons For A Tax Refund Delay And What To Do Next.

On the next screen you will find the status of your income tax refund. Under the e-File menu select Income Tax Returns and click on View Filed Returns. Viewing your IRS account information.

Step 1- Open the income tax e-filling website - incometaxindiaefilinggovin. The Income Tax Department issues the IT refund once the ITR is processed. To check the status of your refund click on the Proceed button.

To check your refund status you must enter your social security number filing status and the exact refund amount. Taxpayers who filed the ITR for year 2021-22 have either received the refund or are waiting for it. You should check the income tax refund NSDL refund status after a month.

If you are using income tax e-Filing to file your tax and you provide your bank account details correctly you will be getting your refund credited directly into their bank accounts within 30 days after the declaration is made. Click on the Proceed button to know the latest status of your income tax refund claim. Usually it takes 25-60 days for the refund to be credited to your account.

Whether you owe taxes or youre expecting a refund you can find out your tax returns status by. The income tax refund status would automatically appear on your screen. Heres step by step guide to check ITR refund status.

Under this category there are two ways of checking the status of your income tax refund. The tools tracker displays progress through three phases. If you have registered on the e-filing website you can follow these steps to check your income tax refund status.

Will display the status of your refund usually on the most recent tax year refund we have on file for you. This means that either. My Account gives you secure online access to your tax return information.

To receive the OTPs apart from the registered mobile number assesses will need their PAN and Aadhar Card details. 06 Sep 2018 0828 AM IST Surajit Dasgupta. This income tax refund status not determined message means the IT Department is yet to process your ITR and determine the refund.

442 PM 9 August 2022. Taxpayers can view status of refund 10 days after their refund has been sent by the Assessing Officer to the. Does Income Tax Department give interest on the income tax refund.

On the subsequent page you will see a list of your previously submitted income tax returns. Enter the PAN the assessment year and the captcha code. Check Online via Income Tax e.

The procedure however is subject to information given in ITRF as well as the submission of supporting documents if required for review.

Average Tax Refund Up 11 In 2021

Malaysia Personal Income Tax Guide 2021 Ya 2020

Malaysia Personal Income Tax Guide 2021 Ya 2020

Malaysia Personal Income Tax Guide 2022 Ya 2021

Guide To Tax Clearance In Malaysia For Expatriates And Locals Toughnickel

The Irs Made Me File A Paper Return Then Lost It

How To File Your Taxes For The First Time

Here S A Guide On How To File Your Income Taxes In Malaysia 2022 Soyacincau

Income Tax Malaysia 2018 Mypf My

Here S A Guide On How To File Your Income Taxes In Malaysia 2022 Soyacincau

Malaysia Payroll What Is Pcb Mtd

Personal Income Tax E Filing For First Timers In Malaysia Mypf My

7 Tips To File Malaysian Income Tax For Beginners

Here S A Guide On How To File Your Income Taxes In Malaysia 2022 Soyacincau

Malaysia Tax Relief Stimulus Measures For Individuals Kpmg Global

Haven T Received Your Income Tax Refund Yet Here Is What To Do

The Complete Income Tax Guide 2022

How I Finally Got My Income Tax Refunds In Malaysia Just An Ordinary Girl

Personal Income Tax E Filing For First Timers In Malaysia Mypf My

Comments

Post a Comment